Louisiana offers residents and businesses clean energy incentives to install solar panels and invest in clean energy vehicles.

In combination with federal tax credits for green energy, the cost of any new equipment installed can qualify.**

TAX INCENTIVE NOTICE*

**Fraud Alert**

US Green Energy

Click Here to Sign Up for Free Solar Panel Installation

| Schedule | Acceptance Date | Last Day To Register |

|---|---|---|

| Q1 | Monday January 1, 2024 | March 30, 2024 |

| Q2 | Monday April 1, 2024 | June 30, 2024 |

| Q3 | Monday July 1, 2024 | September 30, 2024 |

| Q4 | Tuesday October 1, 2024 | December 30, 2024 |

| Q1 (2025) | Wednesday January 1, 2025 | March 30, 2025 |

Entergy Solutions

PLEASE NOTE: Beginning in 2025, the federal tax incentives for solar residential installation will be impacted. See the table below for the dates and amounts currently legislated.

**The Federal tax credit is available every year that new equipment is installed.

Louisiana Government

Louisiana State Capitol

900 North Third Street

Baton Rouge, LA 70802

(225) 342-7317

[email protected]

Open Daily 8:00am – 4:30pm

Entergy Louisiana

446 North Blvd,

Baton Rouge, LA 70802

(800) 368-3749

Louisiana Department of Energy and Natural Resources – State Energy Office

LaSalle Building

617 North Third Street

Baton Rouge, LA 70802

(225) 342-0510

[email protected]

Hours: M-F 8:00am – 4:30pm

Shreveport Weather Bureau

5655 Hollywood Ave.

Shreveport, LA 71109

(318) 631-3669

[email protected]

Hours: Open Daily, 24 hours

Clean Energy and Vehicle Federal Tax Credits

Business Federal Tax Credits

State Tax Credit and Rebate Schedule

| Year | Credit Percentage | Availability |

|---|---|---|

| 2024-2032 | 30% | Individuals who install equipment during the tax year |

| 2033 | 26% | Individuals who install equipment during the tax year |

| 2034 | 22% | Individuals who install equipment during the tax year |

| Property Tax Incentive | 100% | Individuals who install Solar – Passive, Solar Water Heat, Solar Space Heat, Solar Photovoltaics, Solar Pool Heating |

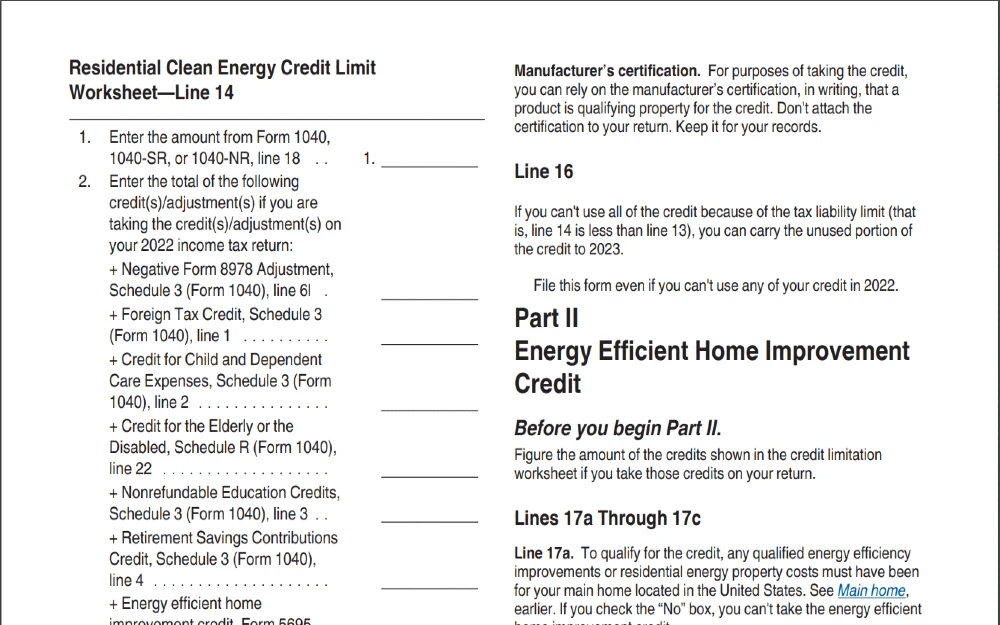

If you have determined that you are eligible for the green energy credit, complete Form 5695 and attach to your federal tax return (Form 1040 or Form 1040NR).

IRS Form 5695

Instructions

Future Due Dates and Basics

Office of Energy Efficiency & Renewable Energy

Forrestal Building

1000 Independence Avenue, SW

Washington, DC 20585

RESIDENTIAL CLEAN ENERGY TAX CREDIT

Louisiana Clean Energy

Carbon Sequestration Program

HELP – Home Energy Loan Program

Energy Efficient Mortgages

Clean Cities Program

Procedure for Claiming Louisiana Income Tax Credits for Solar Energy Systems

Contact

Power Outage Map

Louisiana Department of Environmental Quality

Phone: (225) 219-LDEQ (5337)

Monday – Friday

8 AM – 4:30 PM

602 N. Fifth Street

Baton Rouge, LA 70802

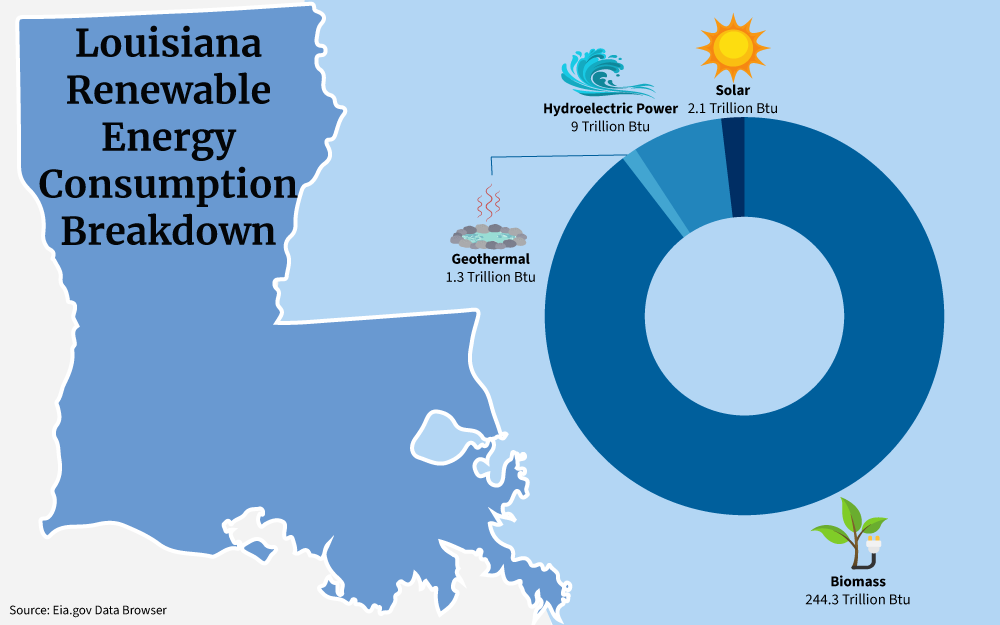

Louisiana Solar Overview

Thanks to federal funding, residents in Louisiana can register for solar tax credits, find enrollment options for renewable energy rebates, and reduce the money they spend on energy.

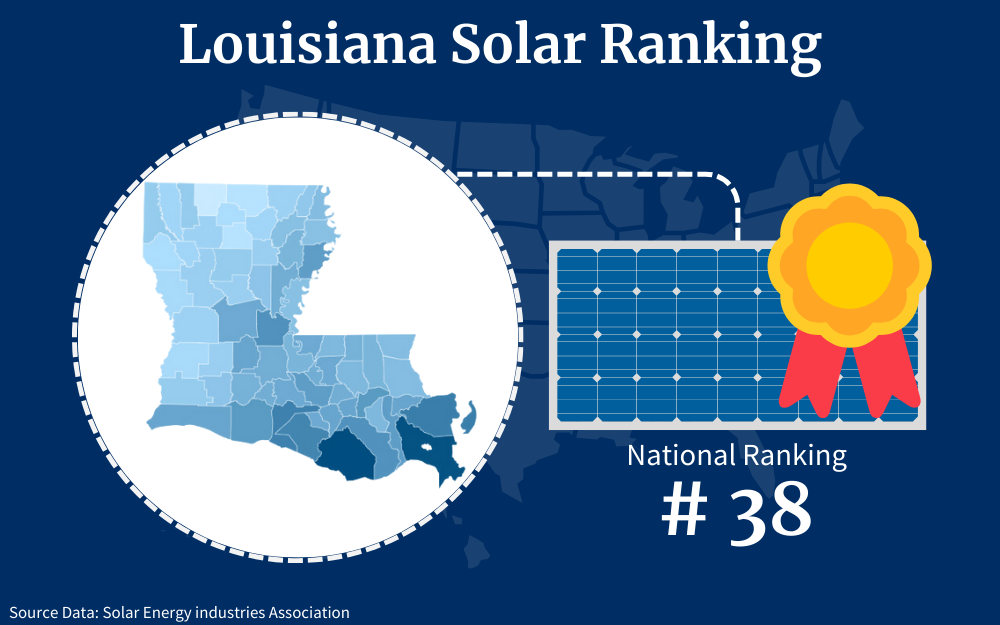

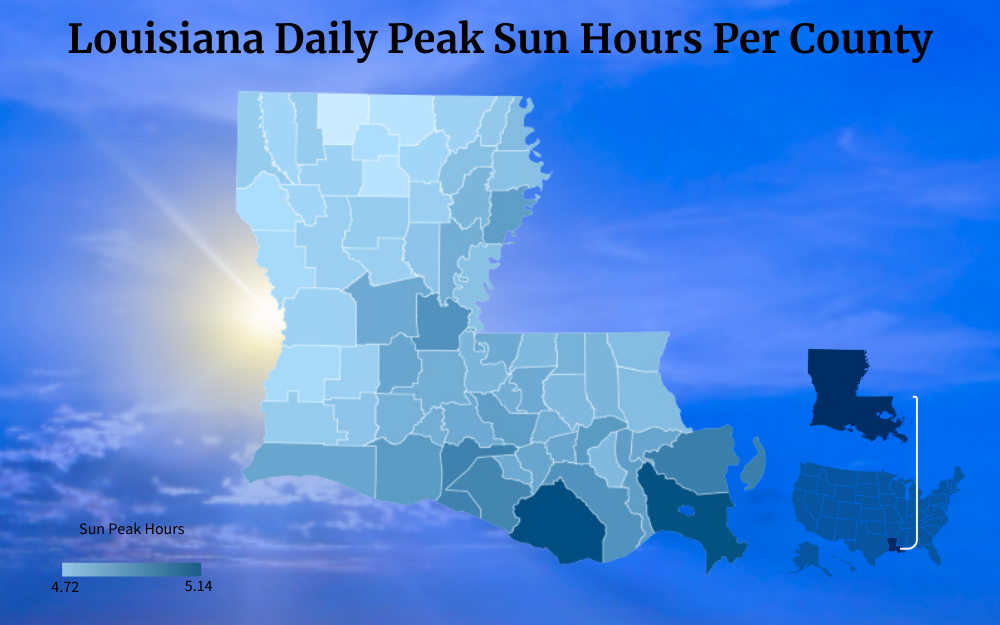

Currently, the state ranks 38th in the nation for solar energy adoption, despite its high amount of daily peak sunlight.

The solar industry in Louisiana has seen its fair share of ups and downs over the last decade. However, generous Louisiana solar incentives, net metering rates, and environmental benefits are encouraging people to choose solar panels as a renewable energy source.

This guide provides information on the available Louisiana solar incentives for homeowners and outlines how much you can save when you choose to go solar for your home energy needs.

Solar Credits That Apply in Louisiana

There are a number of solar credits available to residents of Louisiana who made the switch to renewable energy sources. With the help of these solar incentive programs, individuals and companies can reduce their income tax liabilities by up to 30% and get a good return on their investment in solar energy due to the long lifespan of a solar panel.

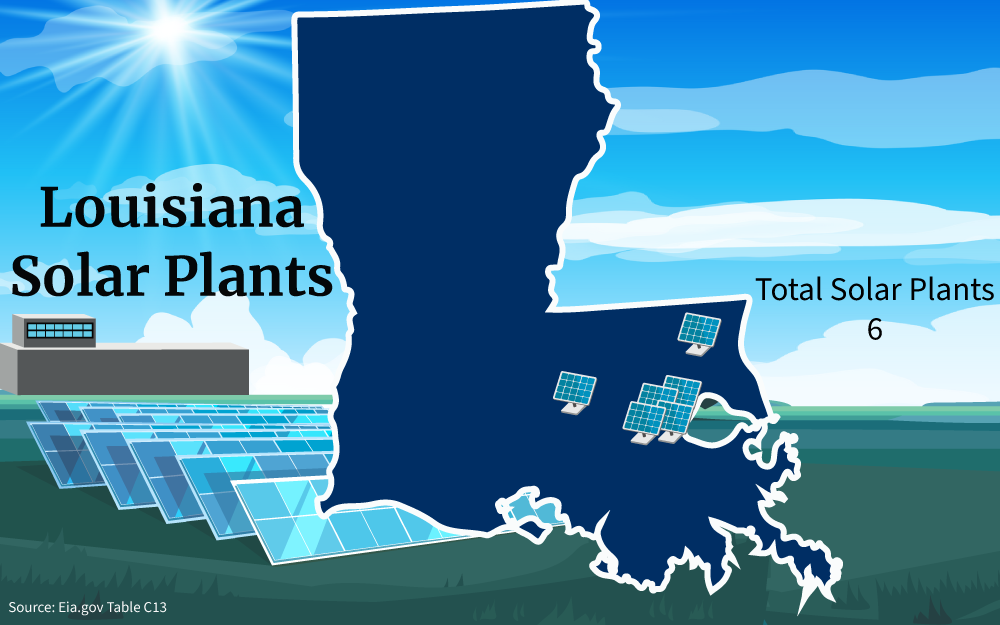

These solar credits are provided by the state and federal government and have helped increase the number of utility-scale solar power plants built and residents that install solar systems within their properties in 2022.1

Keep in mind that while some of these incentives will automatically apply once the solar power system or solar-powered heating system is installed, some will need to be filed using IRS forms, along with purchase and installation transaction documentation.

Also, some of these incentives are only available for a limited period and may change over time as policies, solar energy, and other related markets evolve.

But, what exactly are the Louisiana solar incentives you can take advantage of and how do you do it?

Residential Solar Credits for People in Louisiana

Louisiana residents can take advantage of several different state and federal-sponsored solar credits.

Solar Energy System Tax Exemption in Louisiana

One of the advantages of installing solar energy equipment in residential properties is that it increases the property value. This is favorable to property owners because the increase can make a good amount of profit should they wish to sell in the future.

The only catch is when property value increases, so does the property tax liability. But, why still buy solar panels and install the solar energy system or equipment when it kind of puts you at a disadvantage financially afterward?

The state of Louisiana provides an “ad valorem” or property tax incentive on solar energy systems installed in residential properties. It means that despite the property’s higher assessed value, owners don’t have to worry about higher tax liability because they’ll only have to pay the amount they usually pay before the installment.

The energy systems included in the exemption are solar water heaters, solar PVs, solar space heaters, passive solar cooling or heating systems, and solar pool heating equipment.2

The best about this incentive is that homeowners don’t have to submit any application form to get the 100% financial incentive from the state government on their house solar system.3

Residential Clean Energy Credit (ITC)

The Residential Clean Energy Credit is a renewable energy tax incentive from the federal government which means that it’s not exclusive to Louisiana and is available to all the other states in the country.4 The program was created to encourage people to participate in the government’s initiative to rely on clean energy by 2035 and help families have easier access to renewable energy sources for electricity.

Among the existing state and federal solar tax incentives in the entire country, the Residential Clean Energy Credit is the most advantageous because it gives homeowners as much as 30% off through a tax reduction.

As long as the solar panel installation at residential properties in Louisiana, or anywhere in the US, meets the requirements, individuals can enjoy a 30% deduction on their tax liabilities based on the total cost of the system, which includes the photovoltaic panel, equipment, and labor.

However, the 30% deduction rate is only applicable to systems installed from 2022 to 2032. By 2033, the rate will decrease to 26%, and will further drop to 22% in 2024.

How does the Residential Clean Energy Credit work?

The average solar panel installation cost in Louisiana for a 6-kW solar energy system is $19,020.5 Therefore, the amount that can be deducted from the homeowner’s tax liability is $5,706.

In the event that the credit is greater than the tax owed to the government, the remaining credits can be carried over the next fiscal year.

Another great feature of the incentive is that there is no limit as regards the price of the installation and the size of the system. Homeowners can also install solar panels in their vacation homes and still avail of the incentive.

Indeed, this federal tax incentive is one of the most advantageous incentives one can avail when it comes to renewable energy. However, it is important to note that this is not a reimbursement or refund on the upfront costs for setting up solar panels in your home but rather a deduction on your income tax after complete installation.

Solar Energy Systems Tax Credit in Louisiana

This used to be one of the most helpful tax incentives in Louisiana. Imagine getting a tax incentive of as much as 50% of the cost of the solar panel installation on top of the 30% deduction from the federal government.

The way this incentive works is similar to the Residential Clean Energy Credit; reducing the tax liability of the owner of the system. However, the Solar Energy Systems Tax Credit will be rolled out for 3 years, each having a third of the entire amount.

To put into perspective, having a $19,020 solar system will grant a $9,510 tax credit. That same year, a deduction of a third or $ 3,170 can be applied; the remaining two-thirds will be equally applied to the next year and the year after next.

Unfortunately, the Solar Energy Systems Tax Credit ended in Fiscal Year (FY) 2017-2018 and completely stopped giving grants in FY 2019-2020 after fulfilling all the remaining credits.6

However, recent energy bills passed by the federal government to increase the rate of solar adoption in the country may help change that, and spur the renewal of many states’ solar programs and offers.

Does Louisiana Offer Net Metering and Power Purchasing Agreements (PPA)?

Net metering and Power Purchasing Agreements (PPA) are two key ways that homeowners can get their solar panel systems installed and running.

But how do they work? And what are the benefits of getting into these agreements?

Here are some of the things you need to know about net metering and PPAs:

Net Metering

What is Net metering? Net metering is a mechanism that allows homeowners who choose to have a solar panel grid-connected system to sell any excess solar energy generated by their solar arrays back to the utility company.

This suggests that if your solar panel system produces more electricity than you use in a month, the utility company will pay you for it. You may use the credits you earned to pay your bill should your system generate electricity less than your consumption in the future.

Louisiana used to have the traditional net metering policy, however, in 2019, the Louisiana Public Service Commission published a new set of net metering rules which stated that the excess solar energy from homeowners shall be purchased by electric companies at an avoided cost instead of retail rate and owners are still charged with the full amount of their consumption.17 However the cap on the number of customers who can apply for the program was removed.

The new policy took effect on January 1, 2020, and any installation made before the date would still enjoy the traditional net metering policy for 15 years and would only switch to the avoided cost rate after.

Let’s compare the traditional and new policies. The average avoided cost rate by the electric utility in 2023 is 0.0594 cents.11

For example, your home consumes 1,100 kWh per month and your solar panel system produces 970 kWh.

Under the traditional scheme, you’ll be charged for the 130 kWh at the average rate of 0.1123 cents per kilowatt and you’ll save as much as $108.93 a month.

Reducing Energy Costs With Solar Energy

On the other hand, the new policy mandates the electric utility company charge you for the entire consumption of 1,100 kWh and pay you for the 970 kWh produced at the avoided cost. In this case, your savings would only amount to $57.62.

The policy has reduced the amount each household may potentially save on electric bills by half and this may have been one of the reasons why residential solar panel installation projects grew at a slower rate in 2022.1

But all hope isn’t lost in Louisiana. Despite the lack of RPS and the recent changes in the net metering policies, New Orleans has not entirely adopted the new policy.

If in other counties and cities, you’ll have to pay the utility company for your entire consumption and receive the avoided cost rate for the excess, in New Orleans you don’t have to pay for the entire consumption before you receive the credits. Your electricity consumption will be offset by the capacity of your system and the excess will be bought by the company.

With that in mind, a home in New Orleans consuming 1,100 kWh per month with a residential system producing 970 kWh would save as much as $116.65.

Power Purchase Agreement

Another program that helps homeowners have solar panel systems is through PPAs. A PPA is a contract between you and an energy company; they will help you install a solar system at your property at no upfront cost and pay them for the energy you consume using the system each month for a period of time.

As with any other contract, terms and conditions will vary depending on the energy company you choose to work with, but the main benefit of PPAs is that you don’t have to shell out a large amount of money to enjoy the solar panels renewable energy provides.

Other benefits may include:

- Lower and predictable electric rate: Generally, the rate per kilowatt-hour of your electricity bill is lower than the retail electric price. The rate may be fixed or it may have an annual price increase of 1% to 5% based on varying factors while the contract is enforced.12

- Risk-free: The energy company usually coordinates with a third-party installer who will ensure the functionality and efficiency of the design. It also includes free maintenance of the system throughout the period.

- Possible ownership: Some companies would give homeowners the option to own the system after the contract at no additional cost.

- Property value increase: Having a solar panel system within your property is considered an improvement and will make the assessed property value higher than before the installation.

Home Energy Loan Program (HELP)

Another program that you may consider when looking to get solar panels installed on your property is the Home Energy Loan Program. It offers homeowners a low-interest loan program to help finance home energy improvements.

The Louisiana Department of Natural Resources administers the program and gives a maximum amount of $6,000 at a 2% interest rate payable for 5 years to qualified borrowers.

When you begin the process of having a solar panel installation on your property don’t forget to check out these programs to help you lessen the financial burden and save more.

Can I Fill Out Energy Credit Applications Online?

Definitely. If you want to apply for federal solar tax credits, the IRS provides an online copy of Form 5695 that you need to complete to get the 30% tax rebate.

Here are some steps you need to do to avail of the incentive:

Step 1: Go over to the IRS’s website and look for the “Forms, Instructions and Publications” page.

Step 2: Search for and select Form 5695.14 You can fill out the details on the file and then print it or you can print it and then answer the form.

You have to make sure to read and follow the instructions to help you fill out the form properly and prepare the other documents that you might need when filing.

Step 3: File the form with your other tax forms.

It is important to note that you can only apply for the federal solar tax credit after the completion of the installation.

Solar Panel Installation Costs

Renewable energy sources help reduce carbon dioxide emissions and produce less carbon footprint than burning fossil fuels such as oil and coal. These are the reasons why generating electricity from renewable resources is desirable especially now that the continuous increase in global temperature has affected the intensity and frequency of extreme natural disasters leaving damaging effects to those harmed.

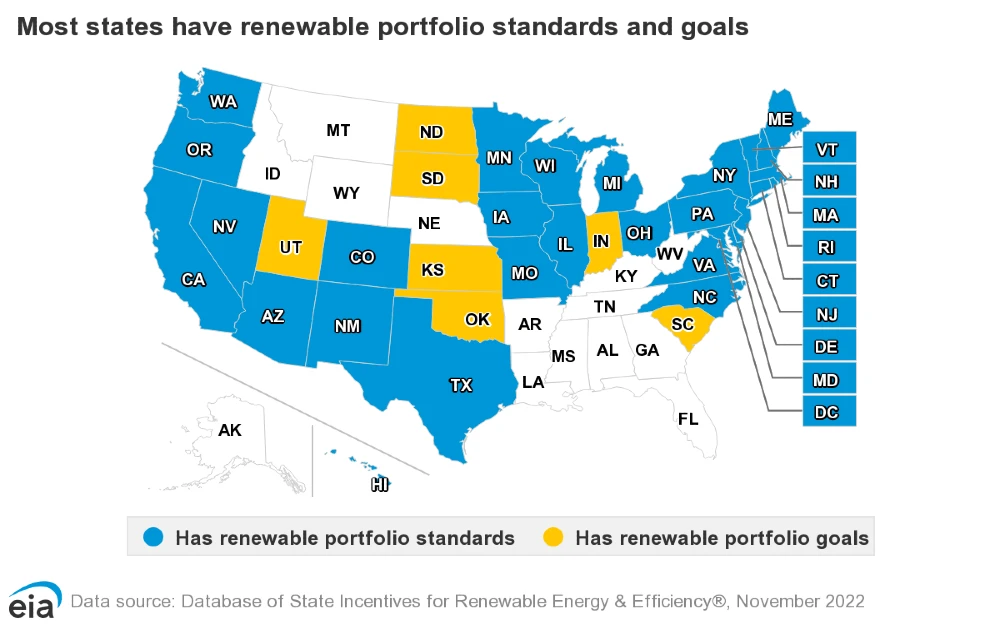

Renewable Portfolio Standards (RPS)15, a state regulatory policy, requires electric companies to produce a specific percentage of their supply using renewable energy sources. This policy helps diversify the energy sources and reduce reliance on fossil fuels.

In the country, there are over 30 states that have their own RPS policies, however Louisiana is not one of them. Despite the absence, the average price of installing solar panels for electricity in residential homes is virtually the same as the national average.

The average residential solar panel installation cost in the U.S.13 is $3.16 per watt while the average cost in Louisiana is $3.17 per watt. This means that the price of a 6-kW solar array is $19,020 and a 10-kW system is $31,700.5

Taking 30% out of $31,700, the amount that a solar panel system owner is equivalent to $9,510.

The initial installation cost will rise as the solar system’s capacity increases, but what other factors will affect the cost of solar panels? How does solar panel material and equipment contribute to the steep price?

Solar Panel Materials

Before learning how to wire solar panels, you must know the different solar panel materials.

Two of the most common types of solar panels are monocrystalline and polycrystalline solar panels;16 both types use silicon in the solar cells of their PV modules. You may be wondering, what is a solar cell?

A solar cell in the modules is a tool that converts the solar energy from the sun which makes it possible to power small gadgets, kitchen appliances, a home, and even an entire community. Solar cells are mostly made of silicon, the 2nd most abundant element on the planet and an excellent semiconductor.

The abundance of silicon makes it a cheap yet highly efficient material to use in making solar panels and when properly maintained, solar panel life expectancy may be up to 30 years and will still have at least 80% of its power-producing capabilities.7

Moving on to the frames and solar panel racking system, the most common materials that are used are steel or aluminum and each has its strengths and weaknesses.

Aluminum is mainly used on solar panel frames, but the most suitable material to use for a solar panel racking system will depend on a number of factors. Here is a table showing the things you should consider.

| Factors | Aluminum | Steel |

| Strength |

|

Stronger |

| Weight | Lightweight | Heavier |

| Corrosion | Durable and generally rust-resistant but some varieties will still corrode when left unprotected |

|

| Price | The material itself is usually more expensive, but if it’s transported to a distance, it’s relatively cheaper due to its lightweight.8 | The material is cheaper, but when transported for a long distance, it’s pricier due to its heavy weight. |

| Place of installation | Best for roof or rooftop mounting | Best for ground-mounting |

Ultimately, the make and place of origin of the metals used in the racking system and the type of mount you prefer will increase the total cost of installing solar panels in Louisiana.

Manufacturing and Manufacturers

The components used in solar panels and racking systems are raw materials that need to undergo various stages of the manufacturing process which would use industrial machines; some of them would need to be sourced using heavy equipment, too. These large machinery and equipment would have astronomical prices amounting to hundreds of thousands of dollars as well as produce carbon emissions when in use.

Along with the machinery and equipment, masters of the trade and trained professionals are needed to run it resulting in higher labor costs. In order to cover the higher expenditure, manufacturers would have to set the price of solar panels high enough to recover the expenses and still earn good profit.

Aside from solar panel production, the brand reputation and number of manufacturers competing play a role in the price range of solar panels in Louisiana. Brands successfully completing a lot of small-scale and utility-scale solar projects will become household names for which they take advantage and impose a higher price on their solar panels.

Additionally, having very few players in the market when the demand for solar panels is high will result in high prices because the solar energy panels available are not enough to meet the number of people looking into installing a solar system within their properties.

Power Electronics, Cables, and Batteries

The solar panel system will not be complete without the power electronics and cables. These are apparatuses and wires that connect each part of the design of a solar panel system to make solar power generation and supply uninterrupted.

Some of the common electronics that are part of the system are inverters, AC and DC disconnectors, charge controllers, and PV meters and optimizers. Inside these gadgets are circuit boards with small diodes and transistors installed with the help of robots, and transformers and capacitors added on the board manually by humans.

Once the circuit board in the electronics is set, the technology will be housed using a waterproof casing with ports where cables can be plugged in to complete the connection in the entire system. The devices help with the conversion of the solar energy gathered from the sun into usable electricity and regulate and/or monitor the flow of electricity from solar panel arrays to home and the grid when owners opt for a grid-tied system.

Those who prefer to have an off-grid system will need to have a lot more budget and invest in purchasing battery storage. These storages will be very beneficial because they ensure that the home will still have enough electric supply at night or when weather conditions affect the amount of solar energy that the panels gather in a day.

So what makes solar panel installation costs in Louisiana expensive? The answer is a lot of factors, from sourcing and type of materials used, manufacturing the solar panels, to the design, location, and size of the system.

How To Use a Solar Savings Calculator

One of the benefits of using solar panels as your home electricity source is the amount of savings you can potentially make over the long haul. There are a lot of solar output calculators that will help you figure out the number of solar panels that you will need to install solar panels in your home.

These calculators would ask a set of questions to help you plan and give you a better perspective of what you may need in terms of the size and capacity of the panels and where is the best place to install the system within your property.

This calculator will help you figure out the number of solar panels that you might need based on your electric consumption.

But let’s go down further and try to calculate the amount of savings you could have by investing in solar panels in your home.

For this example, we are going to use Louisiana’s average yearly energy consumption of 14,302 kWh per residential homeowner and the average residential cost per kWh of 11.23 cents.9 We’re setting up the property in Baton Rouge with a 10 kWh solar panel system.

Step 1: Let’s say that 14,302 kWh is the amount of electricity your household uses each year at the cost of 11.23 cents or $0.1123. You need to multiply these values to get the cost of your energy consumption per year:

14,302 kWh (your annual energy consumption) x $0.1123 (cost per kWh) = $1,606.11 per year

It shows that about $1,606.11 of your monthly budget goes to electricity bills without solar power. Now let’s say you installed an 8 kWh solar panel system that is expected to produce 11,637 kW worth of electricity annually.10

Step 2: You would need to deduct the expected amount of electricity produced by the system from the amount you’re expected to consume:

14,302 kWh (your expected energy use) – 11,637 kWh (solar energy) = 2,665 kWh

Your system covers more than three-fourths of your consumption, but there is about a quarter more that you need to pay to your electric company.

Step 3: Let’s find out how much you have to pay for the leftover energy:

2,665 kWh (leftover energy) X $0.1123 (cost per kWh) = $299.28 per year

With the help of your solar panel installation, you’ll only pay $299.28 per year on electric bills, or about $24.94 per month. This amount will change depending on the location, size of household, and the time of the year, but it generally gives you a good estimate.

Step 4: More or less your total savings would be:

$1,606.11 (total energy cost) – $299.28 (leftover for you to pay) = $1,306.83 in savings annually

This savings calculation is a simplified version and only takes into consideration the averages without accounting for the other factors that might affect the actual values. However, the cost of electricity, your electricity consumption, location, sun peak hours, and the solar panel system capacity are some of the factors that will show you the costs and savings related to switching to solar energy.

But don’t forget the 30% tax deduction of $7,608. When we combine the deduction and the calculated annual savings of $1,306.83, you’ll reach breakeven at least 15 years earlier before your solar panels lose their optimum efficiency.

Where To Buy Solar Panels in Louisiana

Solar panels are a great way to save money on your electricity bill and reduce your carbon footprint. But where should you buy them and what are the things you need to consider when choosing?

Cost and Financing

Solar panel prices are quite expensive and will further increase depending on the type and size of the system you want to have. The cost will also depend on the quality of the materials and whether you prefer to have it by yourself or professionally installed.

To find the best option for your needs, it is best to reach out to several installers and/or suppliers in Louisiana and get quotes. By doing so, you’ll get a better idea of how much you’ll have to spend and can check financial options that will help lessen the upfront costs.

Trustworthiness

The solar panel industry continues to prove to be the most viable option for homeowners who wish to use sustainable and renewable energy sources. And when an industry is booming, expect that there will be scammers trying to convince you to buy solar panels.

This is why it is important to consider the company’s legitimacy and reputation. You can check this by looking for certifications from reputable third-party organizations.

It is also good to conduct research and read some reviews online and if you have friends that have solar panels installed, ask for their opinions.

Another is to go with a company that has been in the business for quite some time and has proven its reliability. These companies have more experience when it comes to products and installation and will ensure that the panels are safe and installed correctly.

Services Offered

It is equally important to look for companies that offer services beyond installing the system. It would be great to find a company that offers after-sales services such as a long warranty period, good customer service, and regular maintenance and cleaning.

The warranty is important because faulty solar panels will get fixed or replaced even after a long period of time. With good customer service, you can be sure that the issues you might have in the future will be addressed quickly and efficiently.

It is important to mention the solar panels’ environmental impact. Knowing that the industry uses machinery and equipment that emit greenhouse gasses one may wonder, are solar panels bad for the environment?

Compared with other renewable energy sources, solar panels are one of those that have a small carbon footprint and in the span of as little as five years can actually offset the carbon emissions generated during manufacturing.

But what about solar panel disposal? Will they simply be unusable and end up in landfills?

Solar panels and solar kits can be recycled and it will be great to find manufacturers that have a solar recovery program for solar panels that have reached their life expectancy. Not only does this reduce the possibility of solar panels ending in landfills and producing toxic wastes, but it also lessens the carbon footprint solar panels produce during manufacturing because acquiring raw materials is not as energy-intensive.

Understanding how you can still employ Louisiana solar incentives to reduce the cost of solar panel installation for your home provides an exceptional and long lasting way to reduce your energy expenses and household carbon emissions.

Frequently Asked Questions About Louisiana Solar Incentives

Is Solar Worth It in Louisiana?

It will depend on where you live in Louisiana. However, solar panels are a good investment because they can lower your electricity consumption using fossil fuels and they can save you lots of money for decades.

Are Permits Required To Install Solar Panels in Louisiana?

Yes, permits are required to guarantee the safety of everyone. This ensures that the residential solar panel system is safely connected to the power grid and that the house roof can handle the weight of the system should it be installed on the roof.

Does DIY Solar Panel Installation Save More Money Than Professional Installers?

It depends on your skill. If you have a wide knowledge of how to wire solar panels safely and securely then you’ll most definitely save money, but if not it is best to have it installed by professionals.

References

1U.S. Energy Information Administration. (2023, June 15). Louisiana | Profile Analysis. eia | U.S. Energy Information Administration. Retrieved August 25, 2023, from <https://www.eia.gov/state/analysis.php?sid=LA#122>

2Williams College. (2023). Passive Solar Design. Williams. Retrieved August 25, 2023, from <https://sustainability.williams.edu/green-building-basics/passive-solar-design/>

3Lindemann, J. (2023, May 25). Solar Energy System Exemption. DSIRE | NC Clean Energy Technology Center. Retrieved August 25, 2023, from <https://programs.dsireusa.org/system/program/detail/888/solar-energy-system-exemption>

4Internal Revenue Service. (2023, August 25). Residential Clean Energy Credit. IRS. Retrieved August 25, 2023, from <https://www.irs.gov/credits-deductions/residential-clean-energy-credit>

5Aggarwal, V. (2023, May 1). How Much Do Solar Panels Cost in 2023? EnergySage. Retrieved August 25, 2023, from <https://www.energysage.com/local-data/solar-panel-cost/>

6Louisiana State Legislature. (2023). RS 47:6030. Louisiana State Legislature. Retrieved August 25, 2023, from <http://legis.la.gov/legis/Law.aspx?d=453218>

7Solar Energy Technologies Office. (2023). Solar Photovoltaic Cell Basics. Energy.gov. Retrieved August 28, 2023, from <https://www.energy.gov/eere/solar/solar-photovoltaic-cell-basics>

8One Monroe. (2016, February 29). Aluminum vs Steel: Comparing the Two ‘Kings’ of Metal | OneMonroe. Monroe Engineering. Retrieved August 28, 2023, from <https://monroeengineering.com/blog/aluminum-vs-steel-comparing-the-two-kings-of-metal/>

9U.S. Energy Information Administration. (2023). Electric Power Monthly. EIA. Retrieved August 29, 2023, from <https://www.eia.gov/electricity/monthly/epm_table_grapher.php?t=table_5_06_a>

10U.S. Department of Energy. (2023). PVWatts Calculator. Louisiana. Retrieved August 29, 2023, from <https://pvwatts.nrel.gov/pvwatts.php>

11Louisiana Public Service Commission. (2023, March 31). Avoided Cost Rate by Electric Utility. Louisiana Public Service Commission. Retrieved August 29, 2023, from <https://www.lpsc.louisiana.gov/docs/utilities/Avoided%20Cost%20rate%20by%20Electric%20Utility_2023.pdf>

12U.S. Environmental Protection Agency. (2023, February 5). Solar Power Purchase Agreements. EPA. Retrieved August 30, 2023, from <https://www.epa.gov/green-power-markets/solar-power-purchase-agreements>

13National Renewable Energy Laboratory. (2023). Solar Installed System Cost Analysis. National Renewable Energy Laboratory. Retrieved September 1, 2023, from <https://www.nrel.gov/solar/market-research-analysis/solar-installed-system-cost.html>

14Department of the Treasury Internal Revenue Service. (2022). Form 5695. Department of the Treasury Internal Revenue Service. Retrieved September 1, 2023, from <https://www.irs.gov/pub/irs-pdf/f5695.pdf>

15U.S. Energy Information Administration. (2022, November 30). Renewable energy explained. U.S. Energy Information Administration. Retrieved September 1, 2023, from <https://www.eia.gov/energyexplained/renewable-sources/portfolio-standards.php>

16U.S. Energy Information Administration. (2023, May 26). Solar explained Photovoltaics and electricity. U.S. Energy Information Administration. Retrieved September 1, 2023, from <https://www.eia.gov/energyexplained/solar/photovoltaics-and-electricity.php>

17Louisiana Public Service Commission. (2023). Welcome to the Louisiana Public Service Commission Website. Louisiana Public Service Commission Website Homepage. Retrieved September 1, 2023, from <https://www.lpsc.louisiana.gov/>

18Jones-Albertus, B. (2023, February 8). Why Go Solar? Connecting the Dots on the Benefits of Solar Energy. Office of Energy Efficiency & Renewable Energy. Retrieved September 8, 2023, from <https://www.energy.gov/eere/solar/articles/why-go-solar-connecting-dots-benefits-solar-energy>

19Screenshot of Instructions for Form 5695 from Internal Revenue Service. IRS. Retrieved from <https://www.irs.gov/pub/irs-pdf/i5695.pdf>